Personalized Advisory for Fundraising

Credit Overview

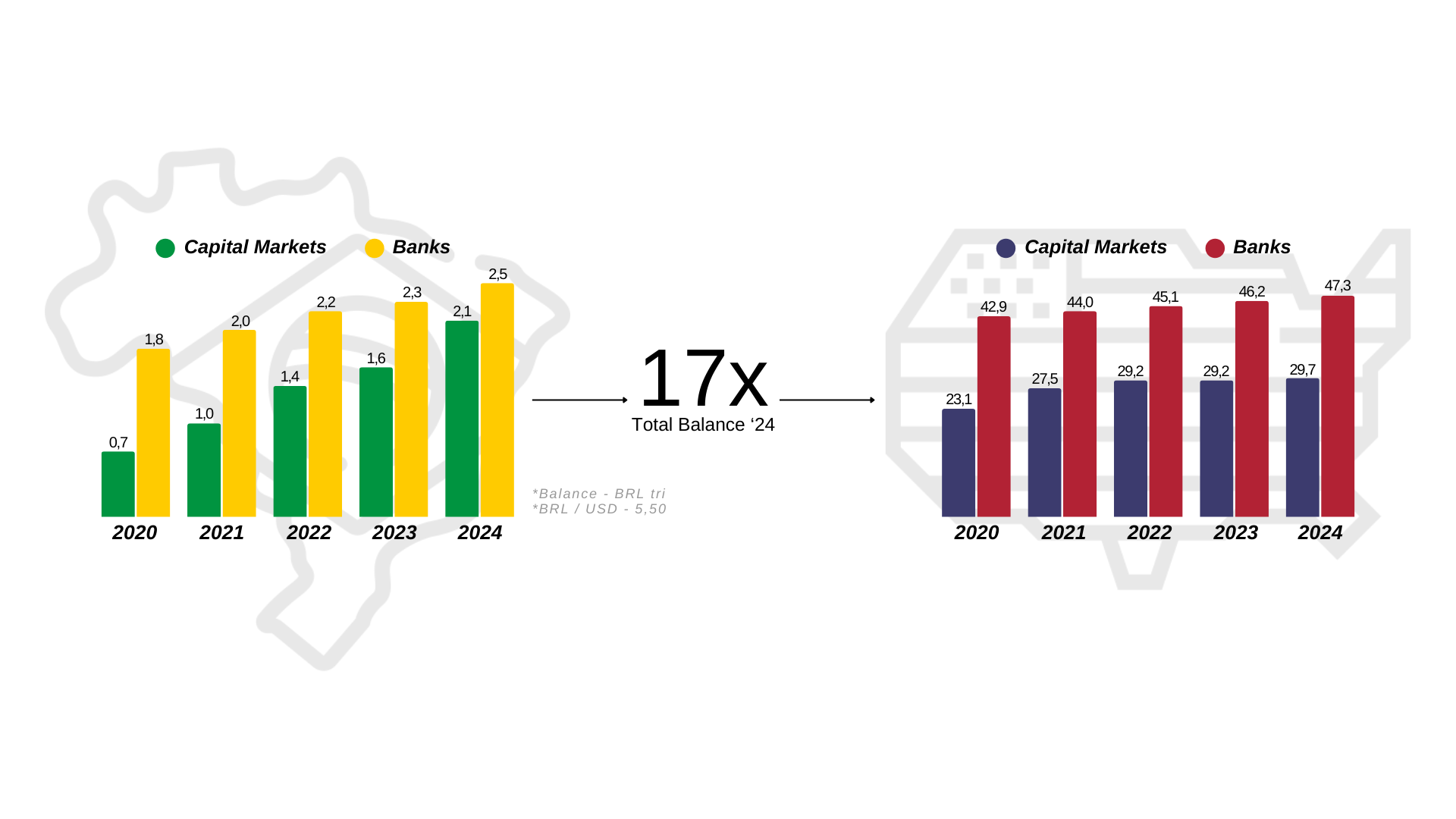

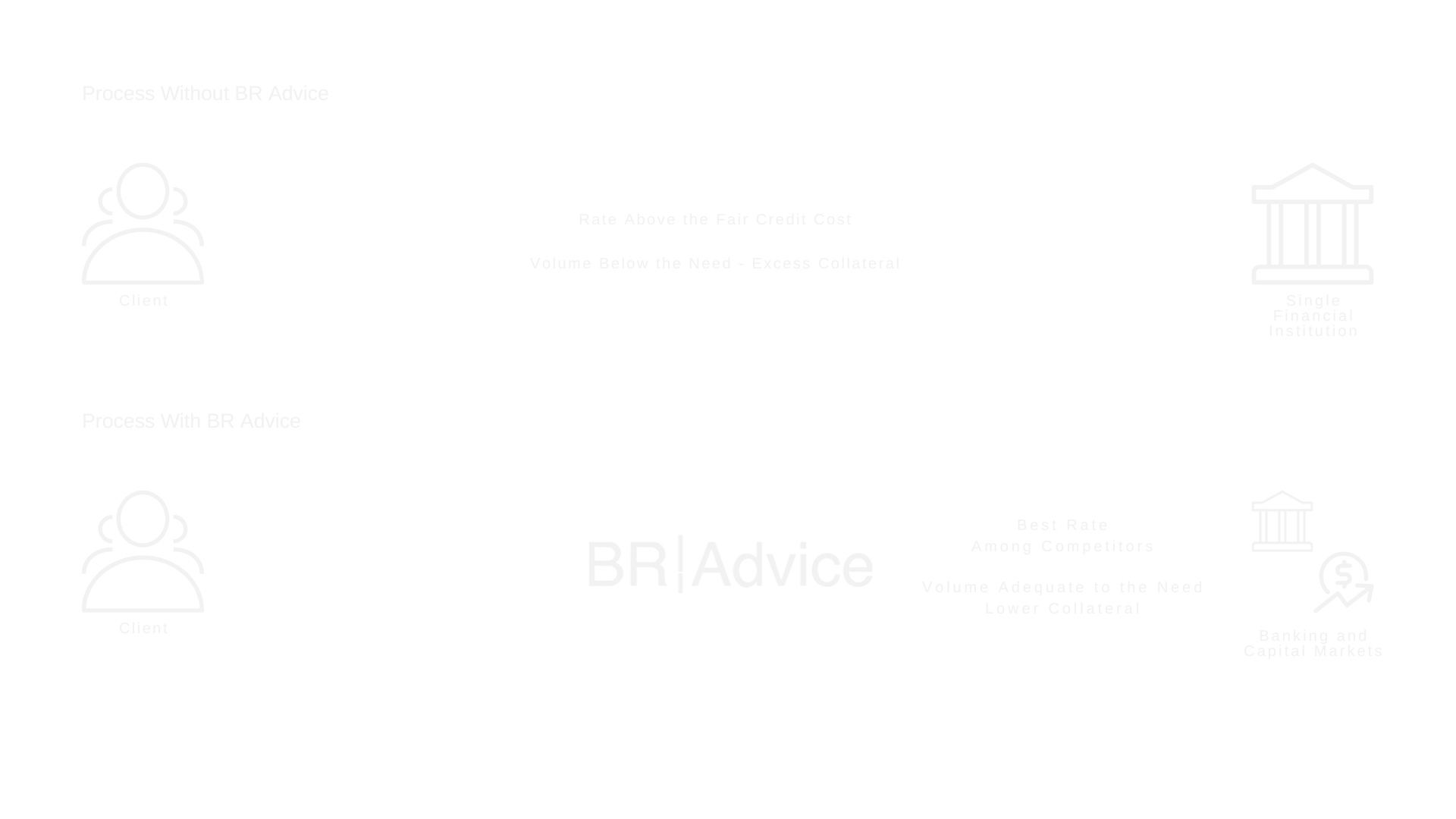

The Brazilian credit market is constantly growing but still has a long way to go compared to the U.S. market. In this context, BR Advice acts as a facilitator, helping mid-sized companies gain greater and better access to credit by bridging the gap between businesses, banks, and capital market agents.

Personalized Credit Advisory

Our team has over 15 years of experience in structuring bank credit and capital markets.

End-to-End Support

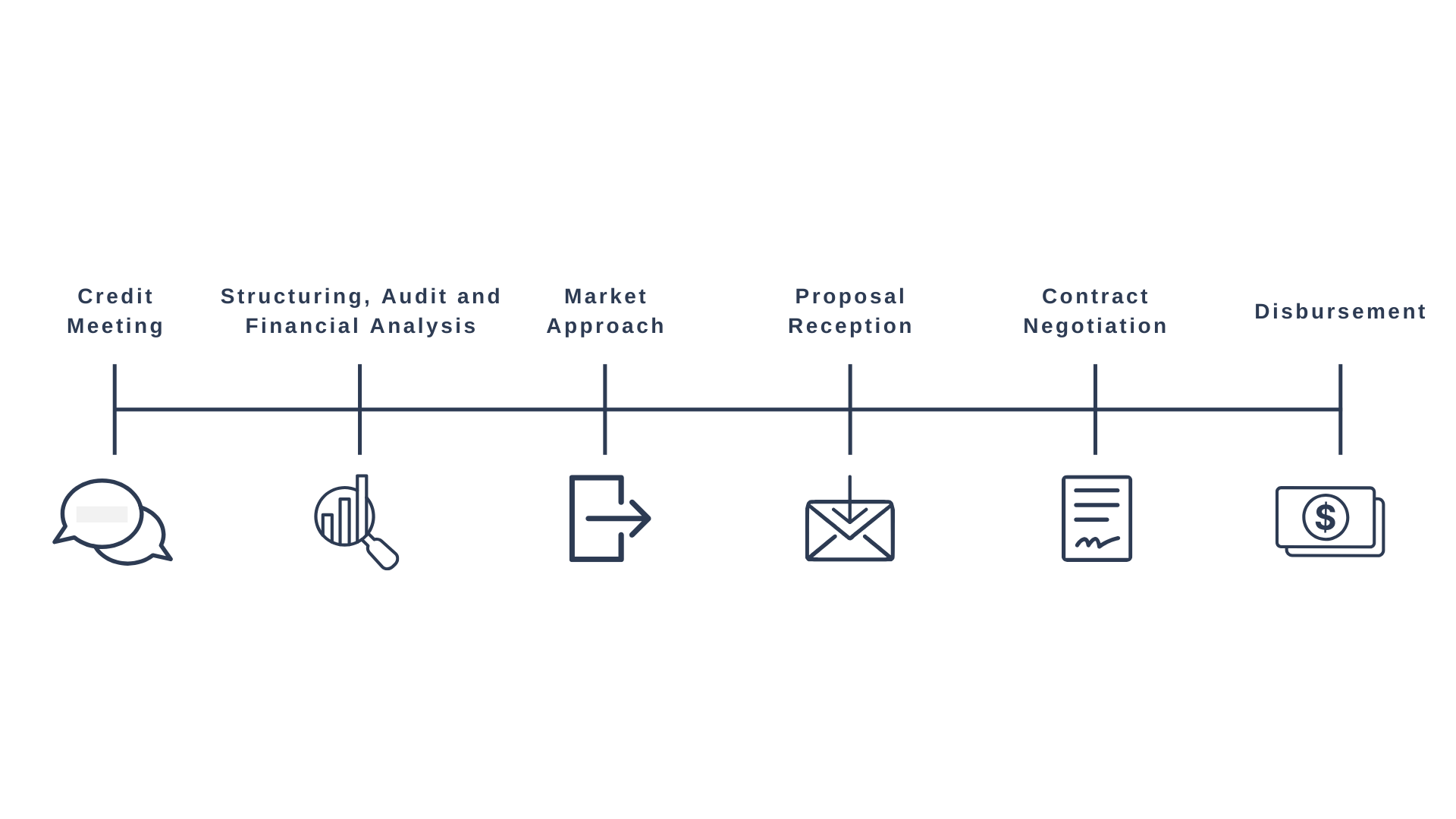

At BR Advice, we provide comprehensive assistance in fundraising, from preparing and analyzing financial materials to disbursement, helping your company secure financing with the best rates and conditions available in the market.

Competitive Process

We work directly with banks and credit funds, ensuring that our clients have access to the best structuring, customized solutions, and financial arrangements tailored to their needs.

Customized Strategic Planning

We work closely with our clients to develop a tailored structuring strategy, focusing on the short, medium, and long term—an essential step for a successful fundraising process.

Speed and Guaranteed Timeline

The timeframe for closing transactions varies based on complexity and credit type, averaging between 90 and 120 days for completion. During this period, we conduct financial audits, detailed analyses, market outreach, and contract negotiations, ensuring that funds are raised under the best possible conditions.

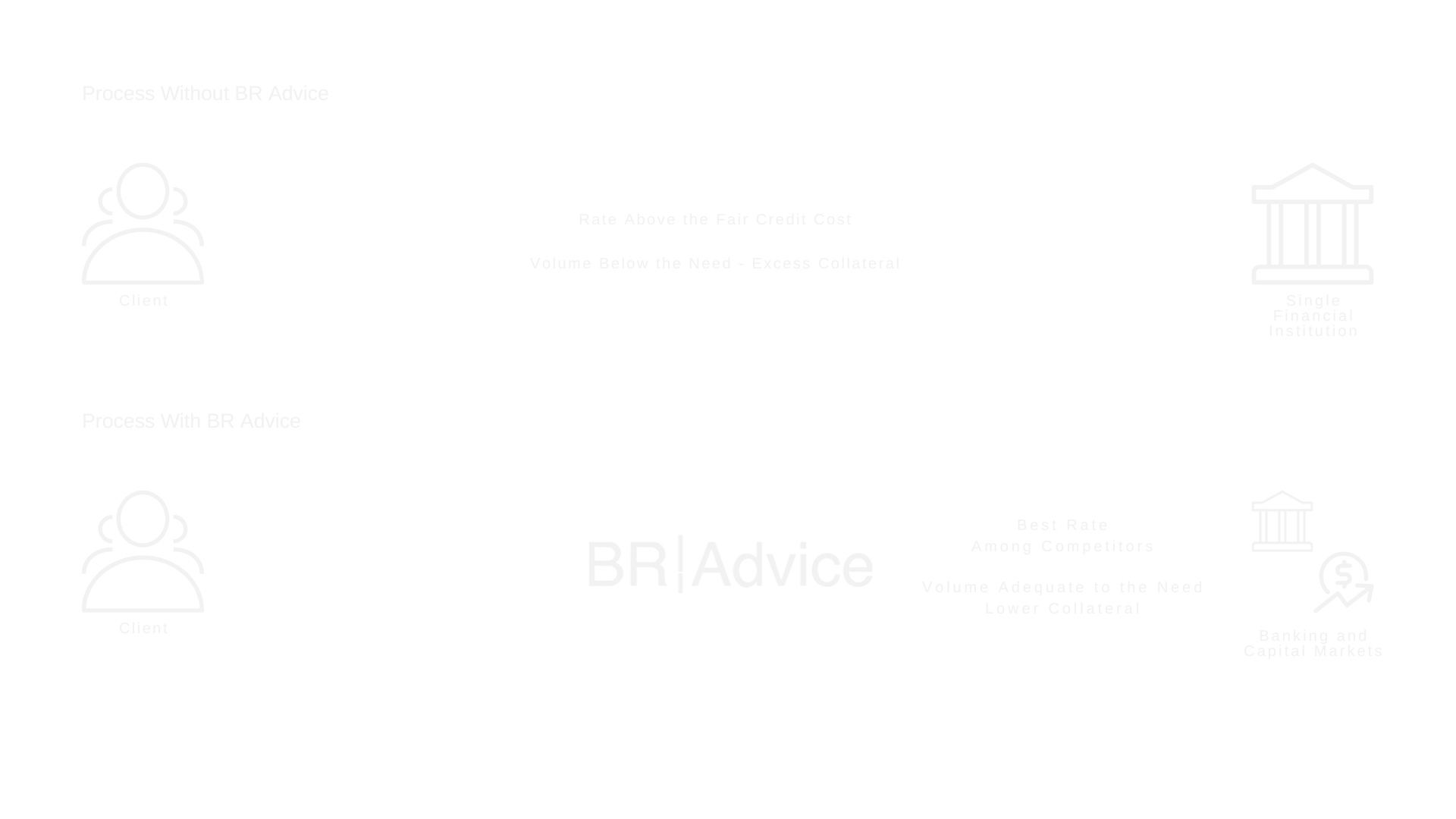

Why Choose BR Advice?

Efficiency and Organization to Achieve the True Fair Cost of Credit.

-

Lower Credit Costs than the current rate, establishing a new baseline for future operations.

-

More Efficient Collateral to optimize financing terms.

-

Negotiation of Longer Grace Periods to provide financial flexibility.

-

Extended Loan Terms for better financial planning.

-

Increased Funding Volume to support business growth.

Credit Purposes

Our approach applies to all industries and stages of a company’s lifecycle. We provide consultancy in structuring various credit products and solutions, tailoring our services to different financial needs.

Rent Advance Financing

This product provides greater liquidity and enables strategic reinvestment of funds, making it ideal for companies with long-term lease agreements that wish to advance their receivables.

Construction Financing

It is an essential solution to ensure project completion, primarily tailored for real estate and infrastructure companies. This product allows businesses to secure funding for construction or renovation projects.

Working Capital and Capex/Investment

Designed for companies needing to strengthen their working capital or undergoing expansion, this product provides financing to cover operational expenses, inventory, or strategic investments for business growth.

Tax Debt / Court-Ordered Payments (Precatórios)

We offer solutions for companies with tax debt seeking refinancing or compensation through court-ordered payments (precatórios). Additionally, we facilitate the sale of credit rights or receivable precatórios, enabling the advance of these funds. This can be an effective tool for balancing cash flow or making new investments.

Refinancing

This product is designed for companies looking to restructure existing debt under more favorable conditions. BR Advice negotiates the best rates and terms in the market, aiming to optimize financial costs, repayment periods, and collateral requirements.

Advance Payment, Performance, and Judicial Guarantees

These products enhance contractual and operational negotiations for companies, providing better treasury allocation by enabling more efficient use of internal cash flow, ultimately leading to higher returns.

Get in touch with our Credit team and find out how we can help your company grow.

Speak with Our SpecialistsWhere We Are

St. Iguatemi, 448 – 3rd floor

Itaim Bibi | 01451-010

São Paulo – SP

Talk to Us

contato@bradvice.com.br

Phone: +55 11 93049-3060

Phone: +55 11 3798-3133

2025 © All rights reserved

Creation: Lemon Soda